The first debit card for the region that builds credit. Get started today!

The choice of the next

generation to build

and get credit.

The revolution has begun,

are you in?

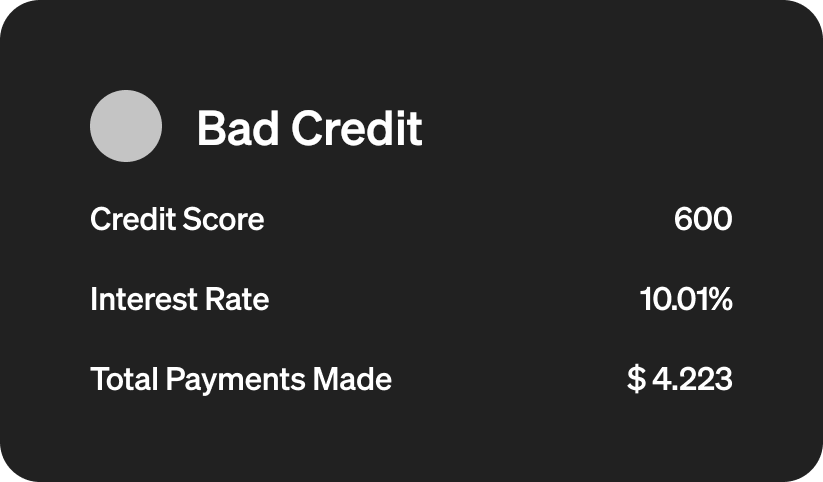

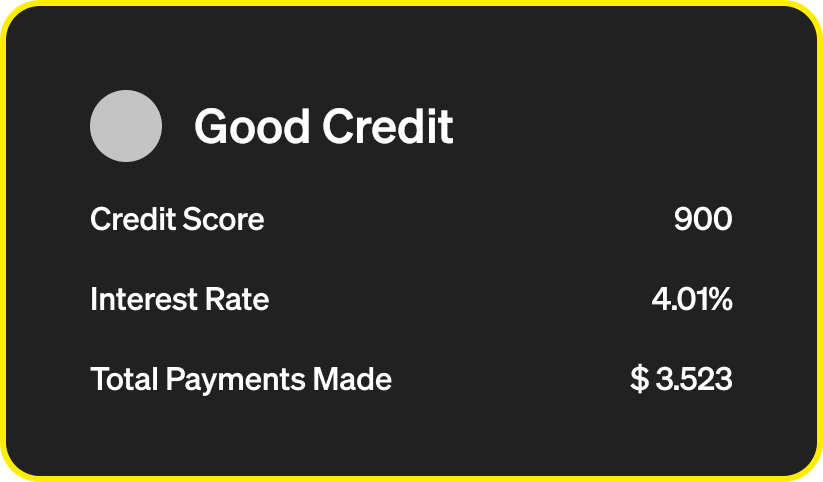

How much does bad

credit cost you?

Macbook pro m1 max

24 month / $ 3.000

Unlock the

power of credit

Get Finllect today to build your path to credit.

Pages

Home

For Lenders

Card

About Us

App

Ambassador

Support

Privacy Policy

Terms & Conditions

© 2022 Finllect