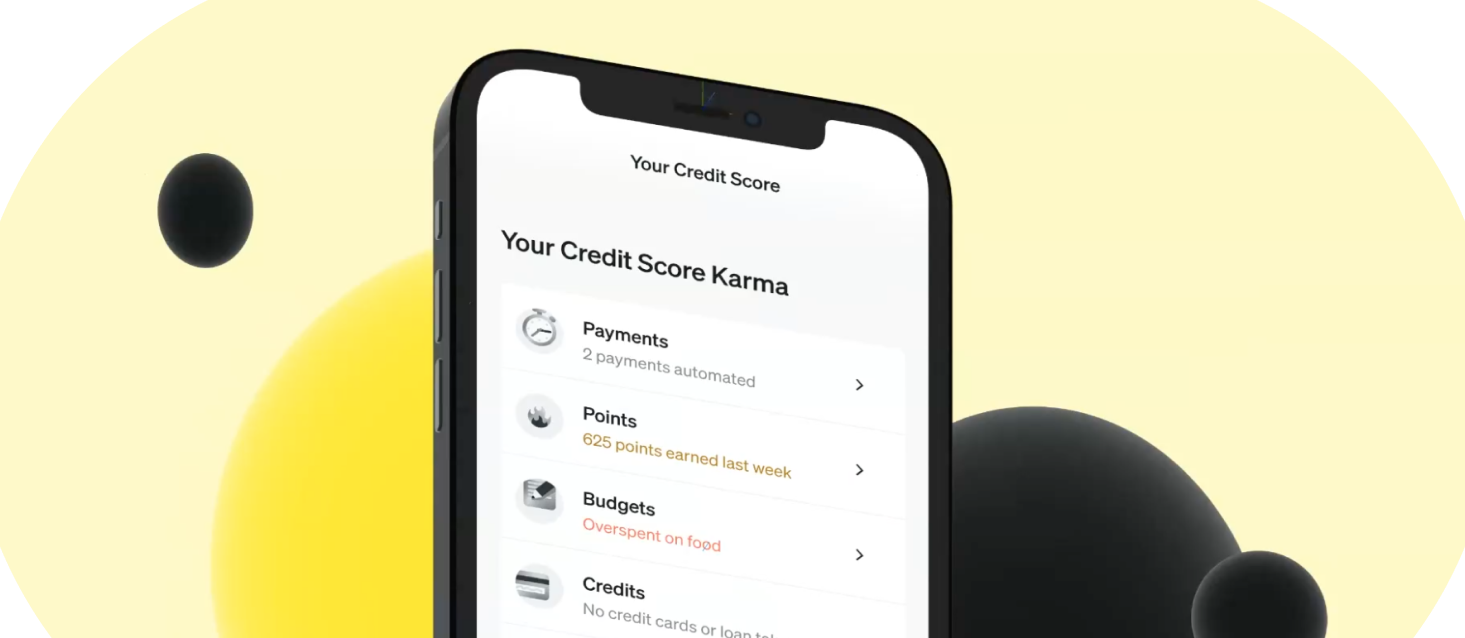

Get the Finllect Card and become one of first people in the Middle East to get access to credit-improving personal finance tools

Credit is broken for all of us, and we’re fixing that.

Finllect's mission is to create economic mobility by prioritising better credit access for the next-gen. The first product, Finllect's credit engine will enable the underserved to build credit using non-traditional financial information and qualify for instant, hassle free loans without any paperwork or waiting periods.

The majority of young adults do not have viable ways of building credit. Many of them don’t know their credit score and/or don’t know how to improve their current one. Once they do decide to start their credit journey, they are left frustrated when they realize the main way to build credit is through having the credit products they don’t yet qualify for. The switching cost for credit cards is high. The applications are tedious and younger applicants are afraid that applying for a new credit card will lower their credit score.

We're on a mission to give everyone access to credit. Finllect offers a free, accessible and scalable alternative to traditional credit scoring. We use real-time financial data from leading financial institutions and behavioral insights from our proprietary machine learning engine coupled with past payments, to accurately categorise the end-user's income, borrowings, and expenses.

We’re on a mission to make credit work for you

Join us in creating equal financial opportunity for all.

Pages

Home

For Lenders

Card

About Us

App

Ambassador

Support

Privacy Policy

Terms & Conditions

© 2022 Finllect