The first debit card for the region that builds credit. Get started today!

CREDIT THAT

WORKS FOR YOU

You deserve credit. You don't deserve to be turned down, especially when the reason is, well, unfair - whether you're seeking financing for villa design Dubai projects or managing daily expenses. That's exactly why Finllect offers an easy, smart and powerful alternative to traditional credit scoring. Welcome to an affordable way to build credit today - to get better credit tomorrow. Unlocking new financial opportunities, from home renovations to major investments. That's credit, done right.

Featured On:

01

SIMPLE

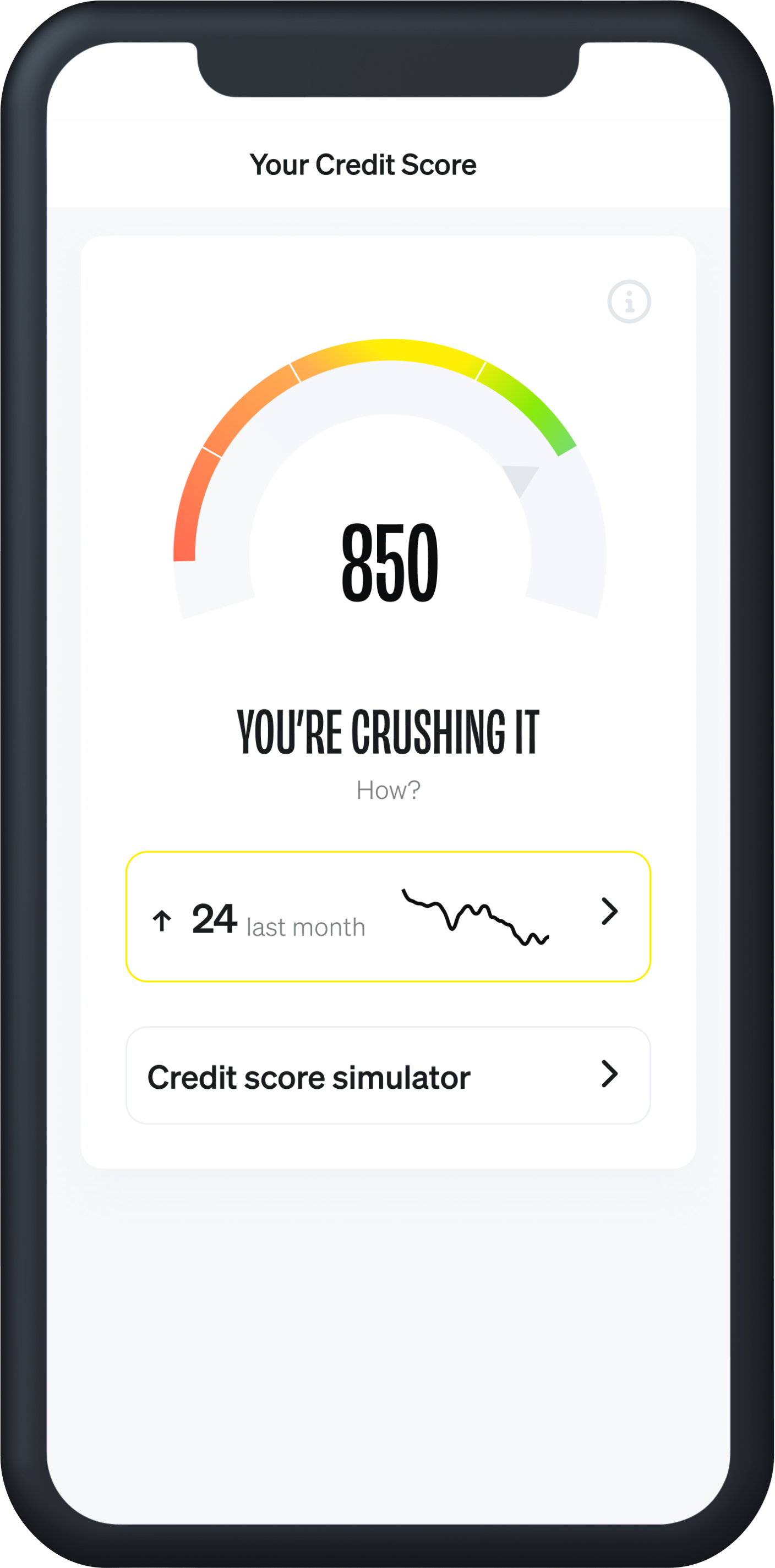

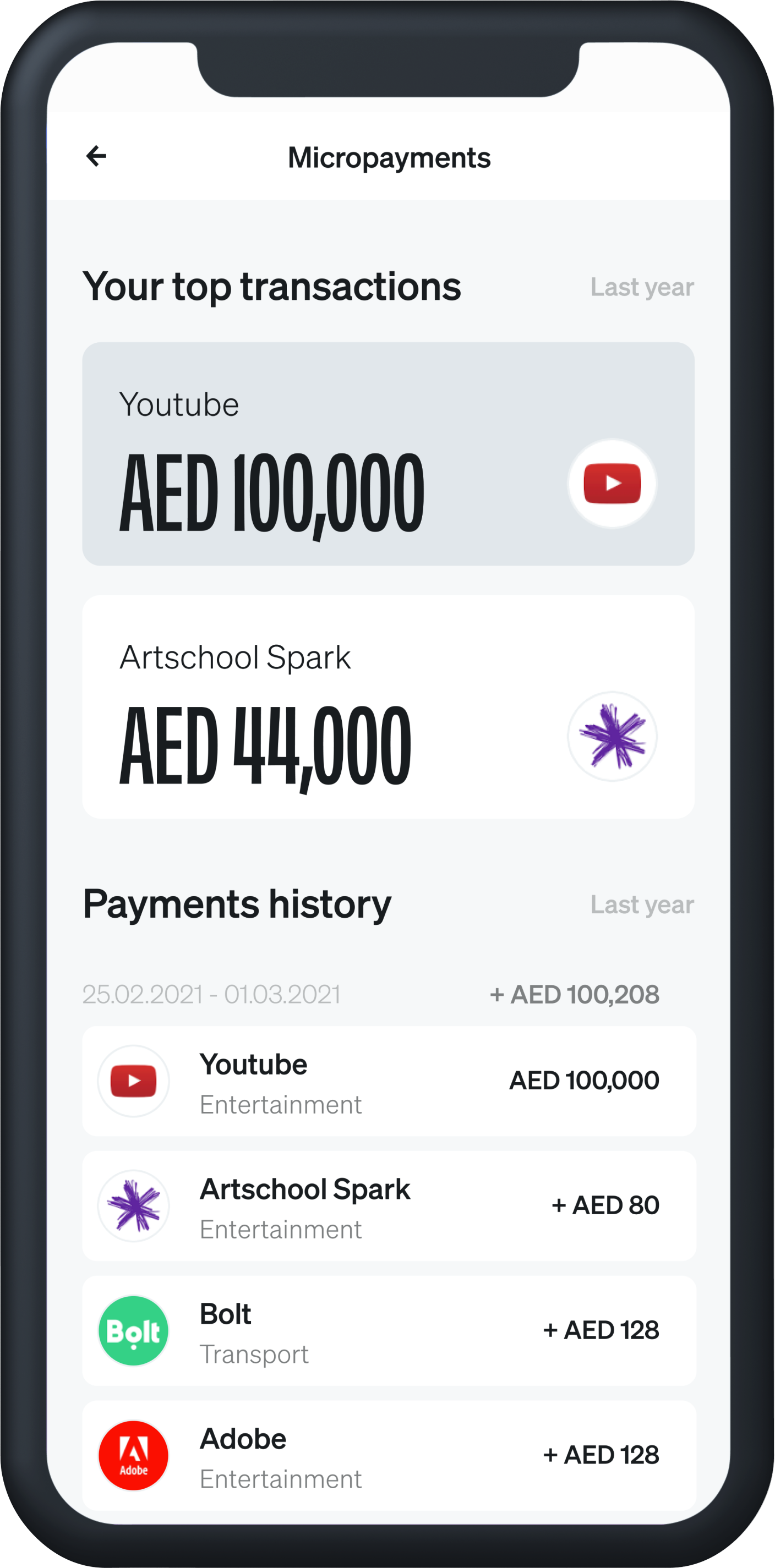

A debit card that builds credit. Become a member to access the region's first credit boosting card. Fund your card on your own terms. Link any of your bank accounts to the card. No security checks, deposits, hidden fees or interest.

02

VIRTUAL

Start building credit in a few minutes. It's a card that follows you, wherever you go. Paperwork is non-existent, as are queues and waiting times. A credit builder that opens doors to a better future for you.

03

CONVENIENT

Finllect combines the predictability, safety and ease of a debit card with better benefits than any credit card. Guaranteed cash back on all payments, exclusive discounts and so much more.

YOUR TRUST

MATTERS.

Your security matters to us. That's why this remains a priority for us. Your transactional data is only used to build your credit score so you can confidently apply for credit and realise your financial goals. Building your credit score is our only mission, so your transactional data is used for that, and only that. We leave no trail.

SECURITY FIRST,

EVERYDAY.

No random pop-up ads or phone calls (at least not from us). We use biometric security, face recognition and checks to support your credit score, so you get credit easily and to ensure your experience is entirely protected.

Traditional banks often overlook millions of data points that could help you get approved. You are worth more than just a number. We're on a mission to transform credit from an industry that inhibits and victimizes through uninformed bias to one that kickstarts and empowers.

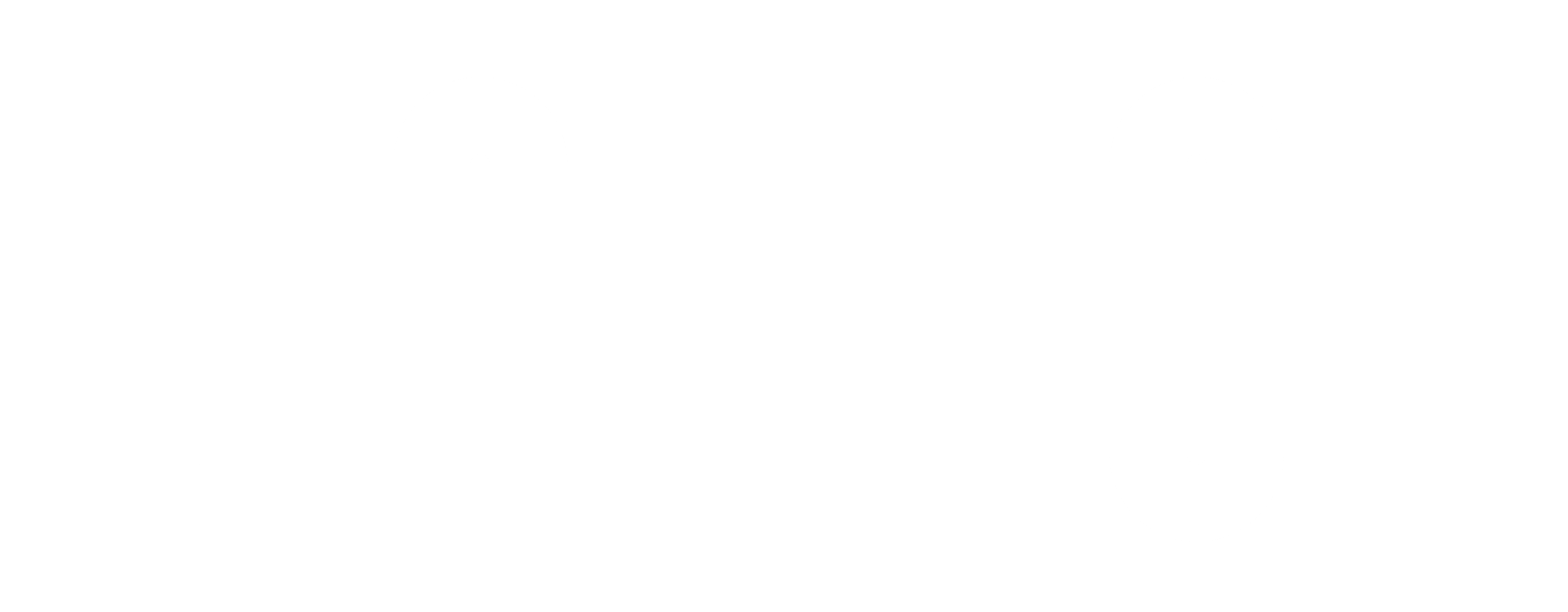

The road to building credit can be long and slow. We're fixing that. Our goal is to help you build a credit score and build the life of your dreams. Our approval process is quick, easy, and will never impact your credit score. See if you are eligible today. After approval, we give you all the tools you need to build positive credit history and track your score.

Own your payments to unlock better credit for you. Every on-time payment you make will help you build your credit. All it takes is one click—and we'll send you reminders to make sure. Our proprietary technology allows everyone, especially those without a credit history to have a fair and equal chance to access credit.

PAVITIRA99

" Very user friendly app, and filled with lots of tips and tricks on how to keep your pockets from draining out! Give you good advice on overall money saving and also helps you to understand the importance of it! If you are looking for information on saving your money this app the way to go!! "

Make the right decisions for you

Download Now

8 Collections, 23 Packs

Get Started

Stay ahead of gimmicks in an age-old system. Make your way through the noise with the right knowledge. Unlock financial opportunities with the tools and content designed to give you credit

01

No hard pulls. No pre-conditions.

02

No previous employment history required.

03

No interest. No fees or hidden charges.

04

Digital-first. Connect to any bank account.

05

Build credit for free using your debit transactions.

TYPICAL

CREDIT CARDS

01

Minimum 750 score. 9-months credit history.

02

Salary certificates. Employment agreements. Proof of historical income.

03

High-fees, unknown interest, repayment terms that require everything you own - and your kids.

04

Manual lines, long waiting periods.

05

Security checks. Post-dated cheque as guarantee.

Get the Finllect Card and become one of first people in the Middle East to get access to credit-improving personal finance tools

How do I get Finllect?

What can I do with the Finllect app?

How many bank accounts can I link to the Finllect app?

Why do I need to upload my identity documents?

Can I change or update my password?

What are points on Finllect? How can I earn them?

What do I need to pay to use Finllect?

What kind of financial content does Finllect offer?

What are quizzes on the Finllect app?

How is the Finllect score calculated?

How can I build my credit score?

What affects my credit score?

Does checking my score affect it?

Why is my credit score important?

What is the difference between Finllect's score and AECB's credit score?

How does Finllect fetch my financial transactions?

Is my data safe?

I have linked my bank account, now what?

What are rewards at Finllect?

How can I redeem these rewards?

What products can I qualify for through Finllect?

Does a qualification guarantee access to the financial product?

CREDIT, DONE RIGHT.

The revolution has begun, are you in?

Pages

Home

For Lenders

Card

About Us

App

Ambassador

Support

Privacy Policy

Terms & Conditions

© 2022 - 2024 Finllect